by Calculated Risk on 8/16/2012 01:42:00 PM

Thursday, August 16, 2012

Quarterly Housing Starts by Intent compared to New Home Sales

In addition to housing starts for July, the Census Bureau released Housing Starts by Intent for Q2. This is a very useful report.

First, we can't directly compare single family housing starts to new home sales. For starts of single family structures, the Census Bureau includes owner built units and units built for rent that are not included in the new home sales report. For an explanation, see from the Census Bureau: Comparing New Home Sales and New Residential Construction

We are often asked why the numbers of new single-family housing units started and completed each month are larger than the number of new homes sold. This is because all new single-family houses are measured as part of the New Residential Construction series (starts and completions), but only those that are built for sale are included in the New Residential Sales series.However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis.

The quarterly report released this morning showed there were 106,000 single family starts, built for sale, in Q2 2012, and that was just above the 103,000 new homes sold for the same quarter (Using Not Seasonally Adjusted data for both starts and sales).

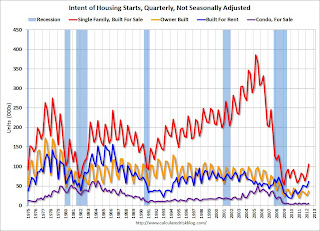

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Click on graph for larger image.

Click on graph for larger image.Single family starts built for sale were up about 28% compared to Q2 2011. This is the highest level since 2008.

Owner built starts were up slightly year-over-year from Q2 2011. And condos built for sale are still near the record low.

The 'units built for rent' has increased significantly and is up about 48% year-over-year.

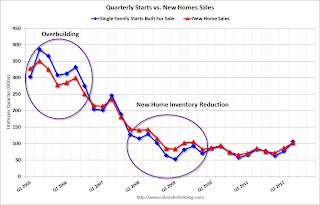

The second graph shows quarterly single family starts, built for sale and new home sales (NSA).

In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.

In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.In 2008 and 2009, the home builders started far fewer homes than they sold as they worked off the excess inventory that they had built up in 2005 and 2006.

For the last 3 years, the builders have sold a few more homes than they started, and inventory levels are now at record lows (117,000 under construction and completed as of June 2012).

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because of the handling of cancellations, but it does suggest the builders are keeping inventories under control, and also suggests that the year-over-year increase in housing starts is directly related to an increase in demand and not renewed speculative building.