by Calculated Risk on 12/28/2011 01:45:00 PM

Wednesday, December 28, 2011

Existing Home Inventory declines 18% year-over-year in December

Another update: I've been using inventory numbers from HousingTracker / DeptofNumbers to track changes in inventory. Tom Lawler mentioned this back in June.

According to the deptofnumbers.com for monthly inventory (54 metro areas), listed inventory is probably back to early 2005 levels. Unfortunately the deptofnumbers only started tracking inventory in April 2006.

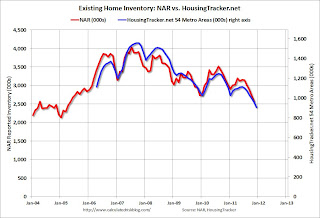

This graph shows the NAR estimate of existing home inventory through November (left axis) and the HousingTracker data for the 54 metro areas through December.

Click on graph for larger image.

Click on graph for larger image.

This is the first update since the NAR released their revisions for sales and inventory. Now the NAR and HousingTracker are pretty close.

There is a seasonal pattern for inventory, bottoming in December and January and peaking during the summer months. So inventory will probably decline again next month and then start increasing in February.

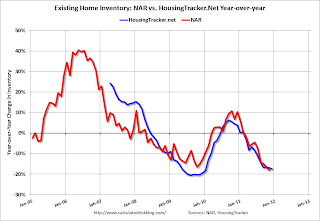

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the December listings - for the 54 metro areas - declined 17.6% from the same month last year. For the final week in December, inventory is down 18.4% from a year ago.

HousingTracker reported that the December listings - for the 54 metro areas - declined 17.6% from the same month last year. For the final week in December, inventory is down 18.4% from a year ago.

This is just inventory listed for sale, sometimes referred to as "visible inventory". There is also a large "shadow inventory" that is currently not on the market, but is expected to be listed in the next few years. Shadow inventory could include bank owned properties (REO: Real Estate Owned), properties in the foreclosure process, other properties with delinquent mortgages (both serious delinquencies of over 90+ days, and less serious), condos that were converted to apartments (and will be converted back), investor owned rental properties, and homeowners "waiting for a better market", and a few other categories - as long as the properties are not currently listed for sale. Some of this "shadow inventory" will be forced on the market, such as completed foreclosures, but most of these sellers will probably wait for a "better market".

However listed inventory has clearly declined in many areas. And it is the listed months-of-supply combined with the number of distressed sales that mostly impacts prices. (note: there are still 7 months of supply because both sales and inventory have declined).