by Calculated Risk on 11/08/2011 07:46:00 AM

Tuesday, November 08, 2011

NFIB: Small Business Optimism Index increases slightly in October

From the National Federation of Independent Business (NFIB): Small Business Confidence Has Minor Uptick

NFIB’s Small-Business Optimism Index gained 1.3 points, nudging the Index up to 90.2. This is below the year-to-date average of 91.1, only slightly better than the average since January 2009 of 89.1.Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

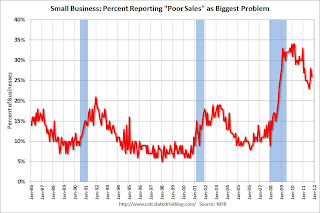

“Consumer sentiment remains at very low levels and is reflected in the 26 percent of small business owners who cite ‘poor sales’ as their biggest problem,” said NFIB Chief Economist Bill Dunkelberg. ...

Click on graph for larger image.

Click on graph for larger image.The first graph shows the small business optimism index since 1986. The index increased to 90.2 in October from 88.9 in September. This is the second increase in a row after declining for six consecutive months.

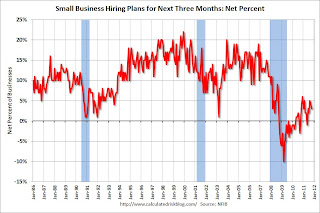

The second graph shows the net hiring plans for the next three months.

Hiring plans were low in October, but still positive and the trend is up.

Hiring plans were low in October, but still positive and the trend is up. According to NFIB: “Over the next three months ... a seasonally adjusted net three percent of owners planning to create new jobs. This is down 1 point from September and 2 points below August, the month that has, thus far, posted the strongest reading for 2011. For some context, in an expansion, this number should exhibit double digit readings."

Twenty six percent of small business owners reported that weak sales continued to be their top business problem in September.

In good times, owners usually report taxes and regulation as their biggest problems.

In good times, owners usually report taxes and regulation as their biggest problems.The optimism index declined sharply in August due to the debt ceiling debate and only rebounded modestly in September and October. This index has been slow to recover - probably due to a combination of sluggish growth, and the high concentration of real estate related companies in the index.