by Calculated Risk on 7/20/2011 08:15:00 AM

Wednesday, July 20, 2011

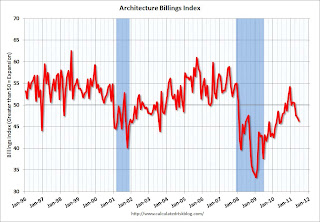

AIA: Architecture Billings Index indicates declining demand in June

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From Reuters: U.S. architecture billings index falls in June

The Architecture Billings Index fell 0.9 point to 46.3 in June, according the American Institute of Architects (AIA).

...

Demand is weakest in the institutional sector that includes government buildings, reflecting depressed government budgets, according to the monthly survey of architecture firms.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the Architecture Billings Index since 1996. The index decreased in June to 46.3 from 47.2 in May. Anything below 50 indicates a contraction in demand for architects' services.

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions. Note that the government sector is the weakest. The American Recovery and Reinvestment Act of 2009 is winding down, and state and local governments are still cutting back.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this suggests another dip in CRE investment in 2012.