by Calculated Risk on 2/17/2011 12:56:00 PM

Thursday, February 17, 2011

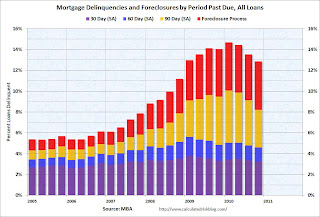

MBA: Loans in Foreclosure Tie All-Time Record, fewer Short-term Delinquencies

The MBA reports that 12.85 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q4 2010 (seasonally adjusted). This is down from 13.52 percent in Q3 2010.

The following graph shows the percent of loans delinquent by days past due.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Loans 30 days delinquent decreased to 3.25% from 3.36% in Q3. This is below the average levels of the last 2 years, but still high.

Delinquent loans in the 60 day bucket decreased to 1.34% from 1.44% in Q3; this is the lowest since Q2 2008.

The biggest decline was in the 90+ day delinquent bucket. This declined from 4.34% in Q3 3.63% in Q4. This is mostly due to modifications or putting the loans in the foreclosure process.

The percent of loans in the foreclosure process increased to 4.63% (tying the record set in Q1 2010). This is due to the foreclosure pause.

Note: the MBA's National Delinquency Survey (NDS) covered "MBA’s National Delinquency Survey covers about 43.6 million first-lien mortgages on one- to four-unit residential properties" and the "The NDS is estimated to cover around 88 percent of the outstanding first-lien mortgages in the market." This gives almost 50 million total first lien mortgages or about 6.4 million delinquent or in foreclosure.

From the MBA: Short-term Delinquencies Fall to Pre-Recession Levels, Loans in Foreclosure Tie All-Time Record

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 8.22 percent of all loans outstanding as of the end of the fourth quarter of 2010, a decrease of 91 basis points from the third quarter of 2010, and a decrease of 125 basis points from one year ago, according to the Mortgage Bankers Association's (MBA) National Delinquency Survey.Note: 8.22% (SA) and 4.63% equals 12.85%.

...

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the fourth quarter was 4.63 percent, up 24 basis points from the third quarter of 2010 and up five basis points from one year ago.

Jay Brinkmann, MBA's chief economist said ... "While delinquency and foreclosure rates are still well above historical norms, we have clearly turned the corner.Yesterday it was announced that an enforcement action (and probable fines) against the mortgage servicers is imminent. As part of any agreement, I expect the servicers will be moving ahead with both more modifications - and also with more foreclosure sales - so the percent of loans in the foreclosure process might have peaked (or will peak in Q1 2011).

...

Mike Fratantoni, MBA's vice president for single family research said "While the foreclosure starts rate fell during the fourth quarter, the percentage of loans in foreclosure rose to equal the all-time high. The foreclosure inventory rate captures loans from the point of the foreclosure referral to exit from the foreclosure process, either through a cure (perhaps through a modification), a short sale or deed in lieu, or through a foreclosure sale. As we predicted last quarter, the percentage of loans in the foreclosure process increased in the fourth quarter, largely due to the foreclosure paperwork issues that were being addressed in September and October. These issues caused a temporary halt in foreclosure sales, particularly in states with judicial foreclosure regimes, such as New Jersey, Florida, and Illinois. With fewer loans exiting the foreclosure process through sales, the foreclosure inventory rate naturally increased, even as fewer foreclosure starts meant that fewer loans entered the foreclosure process in the fourth quarter."