by Calculated Risk on 4/30/2010 11:59:00 AM

Friday, April 30, 2010

A few comments on Q1 GDP Report

The change in private inventories was smaller this quarter - adding 1.7% to GDP in Q1 2010 compared to 4.4% in Q4 2009. It is important to note that the inventory contribution to Q4 GDP was from a slowdown in the liquidation of inventories, but in Q1 businesses were building inventories - and this inventory build will probably slow in Q2.

As I noted earlier, the two leading sectors, residential investment (RI) and personal consumption expenditures (PCE), were mixed. RI declined to a new record low as percent of GDP, however PCE increased at a 3.6% real annualized rate.

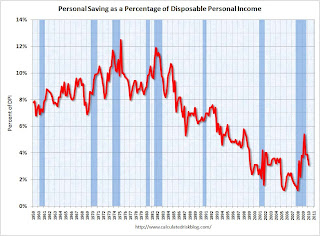

The increase in PCE does not seem sustainable unless employment and incomes increase soon. A large portion of the increase in PCE came from a decrease in personal saving. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows personal saving as a percent of disposable personal income.

It is not unusual for the saving rate to decline at the beginning of a recovery as people become more confident. This helps drive consumer spending, but with the high levels of household debt, I expect the saving rate to increase over the rest of the year.

Here are some Q1 numbers (all annualized):

So the boost in PCE came from the decline in saving and the increase in benefits. That is not sustainable.

The second graph shows real personal income less transfer payments as a percent of the previous peak.

The second graph shows real personal income less transfer payments as a percent of the previous peak.Unlike the recovery in GDP, real personal income less transfer payments has barely increased and is still 6.6% below the pre-recession level.

The peak of the stimulus spending is in Q2 2010 (right now), and then the stimulus spending starts to taper off in the 2nd half of 2010. So underlying demand better increase soon - and that means jobs and incomes going forward.

Unfortunately residential investment is usually one of the key engines for employment and growth at the beginning of a recovery - and I expect RI to be sluggish all year because of the huge overhang of existing housing units. So my guess is the recovery will probably remain sluggish, and I still expect a slowdown in the 2nd half of 2010.